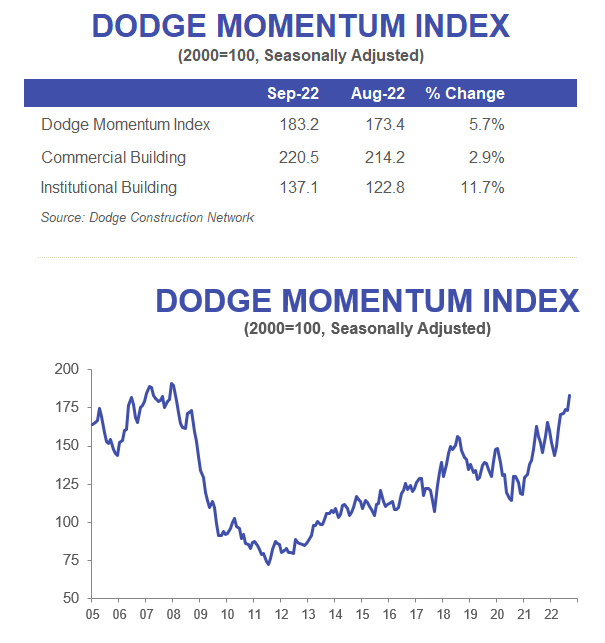

The Dodge Momentum Index, issued by Dodge Construction Network, improved 5.7% (2000=100) in September to 183.2 from the revised August reading of 173.4. The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. In September, the commercial component of the Momentum Index rose 2.9%, while the institutional component also increased, seeing a double-digit gain of 11.7%.

After a solid performance in September, the DMI landed less than 5% below an all-time high. On the commercial side, the figure was primarily bolstered by an influx of data centers entering the planning queue. The institutional component saw a notable increase in research and development laboratory projects in the education sector, with solid contributions from healthcare and recreation projects entering the planning process. On a year-over-year basis, the DMI was 26% higher than September in 2021; the commercial component was up 25%, and institutional planning was 28% higher.

A total of 39 projects with a value of $100 million or more entered planning in September. The leading commercial projects included a $500 million data center campus on the Tech Park at Brambleton site in Ashburn, VA, and the $500 million construction of two warehousing buildings at the Matrix Global Logistics Park’s West Campus in Bloomfield, NY. The leading institutional projects were the $311 million Shoshone-Bannock Casino in Mountain Home, ID, and a $300 million laboratory project at 120 Middlesex Ave in Somerville, MA.

“The gain in the Momentum Index and its components in September reassures us that despite whispers of recession, owners and developers are still looking to move forward with projects to meet demand,” stated David Reaves, senior economist for Dodge Construction Network. “Certain subsectors have shown resilience since the pandemic’s onset, such as data center projects, and continue to stream into the planning pipeline. However, looming challenges still remain for the sector, including supply shortages and the rising cost of materials that could chip away at the flow of new projects if inflation is not tempered.”